What Are House Loan Payment Calculators?

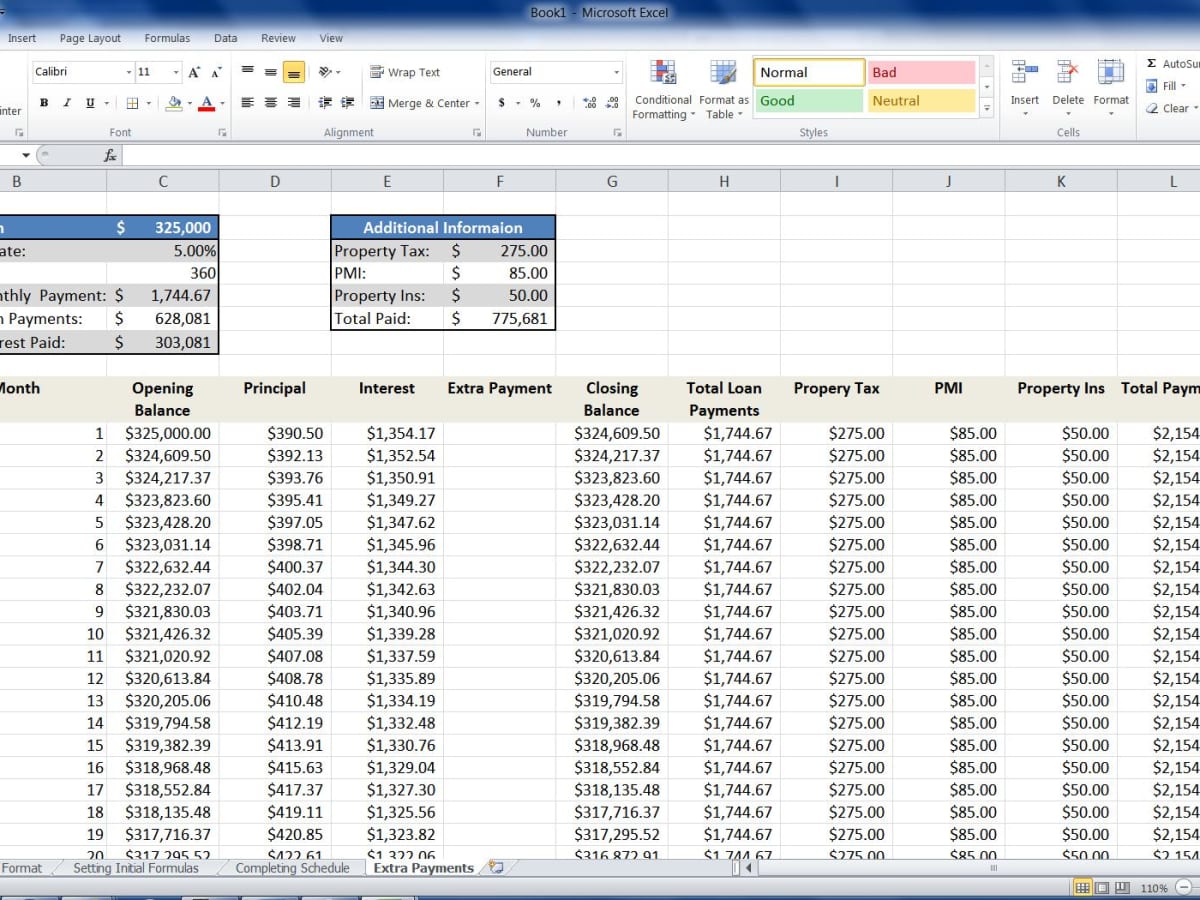

House loan payment calculators are online tools provided by banks, financial institutions, and real estate websites that allow users to estimate their monthly mortgage payments. By inputting key details such as loan amount, interest rate, loan term, and down payment amount, users can obtain an estimate of their monthly principal and interest payments.

How Do House Loan Payment Calculators Work?

House loan payment calculators use mathematical formulas to calculate monthly mortgage payments based on the input parameters provided by the user. These calculations typically include factors such as:

- Loan amount: The total amount borrowed for purchasing a home.

- Interest rate: The annual interest rate charged on the loan amount.

- Loan term: The duration of the loan, typically expressed in years.

- Down payment: The initial payment made by the borrower, expressed as a percentage of the purchase price.

Once the user enters these details into the big home improvement.com/, it generates an estimate of the monthly principal and interest payments, along with the total amount paid over the life of the loan.

Benefits of Using House Loan Payment Calculators

House loan payment calculators offer several benefits to prospective homebuyers:

- Financial Planning: Calculating monthly mortgage payments helps users assess their affordability and budget for homeownership expenses.

- Loan Comparison: Users can compare different loan scenarios by adjusting parameters such as loan amount, interest rate, and loan term to see how they affect monthly payments.

- Budgeting Assistance: By understanding their monthly mortgage payments, users can budget more effectively and plan for other homeownership expenses such as property taxes, insurance, and maintenance costs.

Tips for Using House Loan Payment Calculators Effectively

To make the most of house loan payment calculators, consider the following tips:

- Input Accurate Data: Ensure that you enter accurate information into the calculator, including the loan amount, interest rate, loan term, and down payment amount.

- Consider Future Expenses: Take into account other homeownership expenses such as property taxes, insurance, and maintenance costs when estimating affordability.

- Explore Different Scenarios: Use the calculator to explore various loan scenarios, such as different loan terms or down payment amounts, to understand their impact on monthly payments.

Popular House Loan Payment Calculators Available Online

Several banks, financial institutions, and real estate websites offer house loan payment calculators to the public. Some popular options include:

- Bank Websites: Many banks provide online tools that allow users to estimate their monthly mortgage payments based on current interest rates and loan terms.

- Financial Portals: Financial portals and websites dedicated to personal finance often feature robust house loan payment calculators with advanced functionalities, allowing users to compare multiple loan scenarios.

Conclusion

House loan payment calculators are powerful tools that empower prospective homebuyers to make informed decisions about their mortgage options. By understanding how these calculators work and using them effectively, users can estimate their monthly mortgage payments, compare loan scenarios, and plan for homeownership more confidently.